��ӭ������52ijӢ��������������С��Ϊ�������Ӣ��֪ʶ�ǣ����������¼�ѧӢ����нں�Ϣ ����ͨ��ƽ��衿����������ϸ�ķ�����

�������¼�ѧӢ����нں�Ϣ ����ͨ��ƽ���

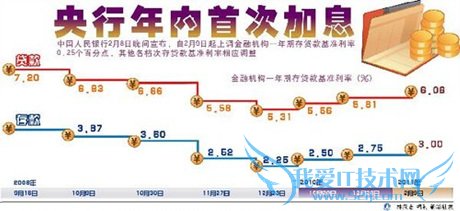

�й��������������³�������ͻȻ������Ϣ����һ�ηֱ��ϵ����ڻ���һ���ڴ���������0.25���ٷֵ㣬���������δ�����������Ӧ��������9����ִ�С������й�����������Ϣ���������γ��֡��ں��Ϣ�����г�Ԥ�ڣ����ڴ��ڡ��ƽ��ܡ������һ�ռ��г��֣���ʾĿǰ�۸��Ŵ������Բ��������

����������ȹ����������ж���������۽������ڻ������߸�ͻ����λ�ã���֮��ȥ��12�·�������ʾ���ز��۸��Կض����ȣ���ϴ���ǰ����Ժ��������ǿӲ�ķ��ز��������ߣ��������߳��ֽ����������������������衣

���������������������

52ijӢ������С��: ��ζδ�����й������ڴ��ڡ��ƽ��ܡ����һ�����ϼ������֣�����2011���һ�μ�Ϣ���ϵ����ڻ�������������25�����㣬�ϵ����ڸ������ڴ��գ��༴����ĵ�һ�������ա���������һ������һ����������������ѧϰһЩ���Ϣ��صĽ��ڵ��ʰɣ�

��Ϣ��raise the interest rates

It can raise interest rates, but that would make the dollar reserve problem even more acute.

�й�����Ҳ���Լ�Ϣ�������ʹ��Ԫ��㴢�������Ϊ����

��������: benchmark deposit

Since China's central bank announced on the 16th, down one-year RMB loans benchmark interest rate 0.27 percentage points, deposit rates remain unchanged.

�й�����������16�����µ�һ��������Ҵ��� ������ 0.27���ٷֵ㣬���������ֲ��䡣

����������tight-money policy

For example, tighter monetary policy may raise the riskiness of shares themselves by raising and weakening the balance sheets of publicly owned firms (Bernanke and Gertler, 1995).

���磬��һ������������������ʳɱ��������˹��ڹ�˾���ʲ���ծ�������������߹�Ʊ�����ķ����ԡ�

������Ӣ�ﲿ��Ϊ52ijӢ������Ӣ��ԭ����ת����ע����������

- �����б����������۽������ѱ�����˿���������������վͬ����۵��֤ʵ��������

-